Selling Your Minneapolis Home: What You Need to Know for a Smooth Transaction

Introduction to Selling Minneapolis Homes

Deciding to sell your home in Minneapolis is a big move, but don't sweat it. The process can be smooth if you're clued up on a few key facts. First things first, Minneapolis's housing market can be pretty dynamic. That means, depending on when you decide to sell, you could be in for a seller's market (where there are more buyers than homes for sale) or a buyer's market (the opposite). Get a real estate agent who knows the Minneapolis market inside out. They can help you set the right price, market your home effectively, and handle all the paperwork. Keep your home in tip-top shape for showings – a little bit of staging goes a long way. And remember, patience is your friend. Sometimes homes fly off the market, and sometimes it takes a bit longer. Be ready for both scenarios. Selling a home is a big deal, but with the right approach, you'll navigate through it like a pro.

Know the Best Time to Sell in Minneapolis

Timing is everything when selling your home in Minneapolis. Spring and early summer, think April through June, are the golden months. This is when buyers come out of hibernation, eager to find their perfect home before the new school year. Gardens are blooming, and your home looks its best, making it more appealing to potential buyers. However, keep an eye on the market because the ideal selling time can shift based on local housing trends and economic factors. Selling in this prime window can mean quicker sales and possibly higher offers as buyers compete for their dream home in the beautiful Minneapolis setting.

Preparing Your Home for Sale: Tips and Tricks

Before you stick that "For Sale" sign in your yard, make sure your home makes a stellar first impression. Here are quick, impactful ways to prep your place:

Declutter like a pro. Get rid of anything you don't need. Think less is more. This makes your space look bigger and more inviting.

A fresh coat of paint goes a long way. Neutral colors work best—they help potential buyers picture themselves in the home.

Fix the small stuff. Leaky faucet? Squeaky door? Tiny problems can be big turnoffs. Fix them.

Boost your curb appeal. First impressions are everything. Mow the lawn, plant flowers, and make sure the front of your home looks welcoming.

Clean, then clean some more. Your home should sparkle. Consider professional cleaning, especially for carpets and windows.

Doing these things won't just help sell your home faster; they could also bump up the price. A little effort now pays off in the end.

Setting the Right Price for Your Minneapolis Home

Setting the right price for your Minneapolis home is the first big step in attracting serious buyers and closing the sale quickly. Price it too high, and your home might sit on the market, becoming less appealing over time. Price it too low, and you might lose out on potential profits. So, how do you find that sweet spot? You start by understanding the local Minneapolis real estate market. Look at what similar homes in your neighborhood sold for recently. Consider factors like location, size, and features of your home compared to others. Next, think about hiring a professional appraiser or working with a real estate agent who knows the Minneapolis market inside out. They can give you a realistic picture of what your home is worth based on current trends. Remember, the right price can make all the difference in selling your home smoothly and efficiently.

Marketing Your Minneapolis Home: Effective Strategies

To sell your Minneapolis home quickly and at a good price, your marketing game needs to be on point. Start with high-quality photos that showcase your home's best features. This isn't the time for blurry smartphone pics; consider hiring a professional photographer. Next, list your property on popular real estate websites and social media platforms to get maximum exposure. Use catchy, descriptive titles that highlight your home’s best attributes, like a newly renovated kitchen or a spacious backyard. Don’t forget the power of a well-placed sign in your yard; it catches the eye of passersby who might be your next buyer. Hosting open houses can also entice potential buyers to envision themselves living in your space. Finally, telling a compelling story about your home can connect emotionally with buyers. Was it the setting of memorable family gatherings or the first piece of property you ever bought? Share it. This blend of high-quality visuals, widespread online presence, strategic signage, engaging open houses, and personal storytelling will make your Minneapolis home irresistible to the right buyer.

Understanding the Legal Aspects of Selling in Minneapolis

When you're selling your home in Minneapolis, getting a handle on the legal stuff is crucial. It's not the fun part, but it's key for a smooth sale. First off, Minnesota law requires sellers to fill out a disclosure statement. This is where you tell buyers about any major problems your home might have, like leaks or a busted furnace. It's all about being upfront so there are no surprises. Then, there's the title. You need a clear one to sell. This means the property must be yours to sell, with no lingering loans or claims against it. Sometimes, people find out too late there's a lien on their property, and it can mess things up big time. Also, think about hiring an attorney. Real estate laws can be a maze, and having a pro by your side can help you avoid pitfalls. They can handle the paperwork, make sure the contract is fair, and give you peace of mind. Remember, every piece of paper you sign matters. Read everything carefully, and don't rush. Selling your home is a big deal, and understanding the legal aspects is a big part of making it go smoothly.

Open House and Private Showings: How to Prepare

Preparing your home for open houses and private showings is crucial in making a good first impression on potential buyers. Think of it as setting the stage for a play where your home is the star. Here's how to make potential buyers fall in love with your place. First, declutter and depersonalize. You want buyers to envision themselves living in your home, which means removing personal items like family photos and collectibles. Next, focus on deep cleaning. Every corner of your home should shine, from the floors to the ceilings, making everything look well-cared-for. Don't forget about fixing anything that's broken. Whether it's a leaky faucet or a creaky door, small fixes can make a big difference in how buyers perceive your home. Lighting is also key. Bright, well-lit rooms not only look bigger but also more inviting. Open the curtains, clean the windows, and add lamps if needed to brighten up any dark spaces. Lastly, consider the curb appeal. The outside of your home is the first thing buyers see, so make it count. Mow the lawn, trim the bushes, and maybe even add a few colorful flowers to make everything look welcoming. These steps can make your open house or private showing a success, helping you sell your Minneapolis home faster and for a better price. Just remember, you're not just selling a house; you're selling the idea of a home.

Negotiating Offers: Tactics for Minneapolis Home Sellers

When you get an offer on your Minneapolis home, you're entering the negotiation arena. This isn't just about saying yes or no; it's about strategy. First up, know your minimum acceptable price but keep that under wraps. When an offer comes in, don’t jump on it immediately. Pausing, even for a bit, shows you're not desperate.

Second, understanding the buyer's position can give you an edge. Are they in a rush? Do they seem super keen on your place? Use this info to your advantage. If a buyer really wants your home, they might be more flexible on the price.

Another tactic is to counteroffer. Don't just focus on the price; consider closing dates, paying part of the closing costs, or throwing in appliances. These can sweeten the deal for both sides without drastically changing the price.

Remember, every offer is a starting point. It's rare for the first offer to be the last. Be ready to go back and forth a few times. And keep your cool. Negotiations can get heated, but the goal is to sell your home at a good price, not to win an argument.

Lastly, always have a backup plan. If negotiations stall, knowing your next move keeps you in control. Maybe it's lowering the price, renting out your home, or taking it off the market for a while. Either way, a backup plan means you're never stuck.

Negotiating offers is part chess, part poker. Use what you know, keep your cards close, and aim for a win-win situation.

Closing the Deal: What to Expect in Minneapolis

Closing the deal on your Minneapolis home means you're in the final stretch. Here's what to expect. In Minnesota, it's normal to sit down for a closing meeting. This is where all the paperwork gets signed, making the sale official. You, the buyer, and often a neutral closing agent will be there. Expect to sign a lot of documents – it's not just a couple of signatures. Before this meeting, you'll want to confirm that all agreements, like who pays for closing costs or any repairs, are clear. Speaking of costs, in Minneapolis, sellers typically cover certain fees, like the broker's commission, while buyers handle others, including title insurance and loan-related costs. After signing all the paperwork, the buyer pays the agreed upon amount, often through a wire transfer or a cashier's check. Once the money is sorted, the keys change hands. And that's it! Your house is sold. Closing in Minneapolis is pretty straightforward, but it pays to be prepared and know what to expect.

Final Checklist for Minneapolis Home Sellers

Before you hand over the keys, there's a final checklist you should tick off to ensure a smooth sale. First up, your paperwork must be in order. This includes your home's title, any warranty documents, and your closing documents. Misplaced any of it? Now's the time to dig deep and find them. Next, give your home one last deep clean. Buyers remember the little details, so make those countertops shine and those floors sparkle. It's also smart to remove any personal items that might still be lurking around – think family photos or your kids' artwork on the fridge. Now is also the time to double-check that all repairs agreed upon after the home inspection are completed. No buyer wants a last-minute surprise. Then, make sure you've canceled or transferred your homeowners' insurance and utilities. Last thing you want is to pay for lights in a house you no longer own. Lastly, do a final walk-through of your home. It might be emotional, but it's also a chance to ensure you're not leaving anything behind. Follow this checklist, and you’re all set for a smooth transaction.

Spring Simmer Pot

Spring Has Sprung!

What is a Simmer Pot? A Simmer Pot is a stovetop potpourri that combines ingredients that bring the pleasing scents and good energy into you home — but without the pollutants that a candle could bring. Whenever I have a simmer pot going it reinvigorates our entire house.

For any Simmer Pot you can always mix and match to your preference. Some inspiration includes fresh citrus fruits, herbs such as rosemary or thyme, and flowers like chamomile, daisies, or roses.

My favorite recipe for Spring 2024 is:

4 cups Water

2 sprigs Rosemary

2 large Lemons, sliced

Handful of Chamomile Buds

Dutch Oven

Let everything simmer on low for as long as you’d like. I keep my pots going for long lengths of time and add water as needed.

Let me know how you enjoy yours!

NAR Settlement Update - How will this affect me?

With the recent NAR news, it’s imporant to know a few things:

Agents are now required to have signed buyer agreements in place with any buyer they are working with. This is already standard practice in Minnesota, as far as I know, but other states have different rules and some states don’t have this requirement in place. Now it’ll be standard practice nationwide. Want to see a property? You will need to have a signed buyer agenct agreement in place.

Buyer agent compensation can no longer be shown on MLS listings.

Right now, on every active MLS listing, any real estate agent can look at any listing and see what the seller is offering as compensation to the buyer’s agent.

The lawsuit deemed that this information did not serve the consumer’s best interest and, as a result, this will be removed from MLS July of this year. The 2.7% comp number is the buyer agent standard for the Twin Cities metro area, but that number is established by the seller and their agent. It can be any number the seller chooses, and that’s always been the case. Sometimes, sellers’ opt to offer 2.5% or 2.0%, or $5,000, or pick a number. It’s not that common, but it happens. The plaintiffs in the lawsuit felt that any number lower than the standard would result in buyer agents skipping that listing for something offering better pay. So, when I work with you as a buyer, I’ll be having more personal conversation both you and the seller’s agent, so that it’s understood what the seller’s offer of compensation to the buyer agent IS, before homes are shown or offers are made.About the 6% number you may have read about … The total compensation paid by the seller is always split between BOTH the seller’s agent and the buyer’s agent and it can be any percentage that the seller and their agent agree to. That number is, and has always been, negotiable between the seller and the seller’s agent. There have been plenty of headlines saying that “6% is going away”. I just don’t see that happening as a result of this lawsuit.

Everything is ok this is not as alarming as news outlets have made things seem. Turn those mental alarms off 🚨 If you have questions about what you’ve heard or read, shoot me an email and I’d be happy to talk with you about it!

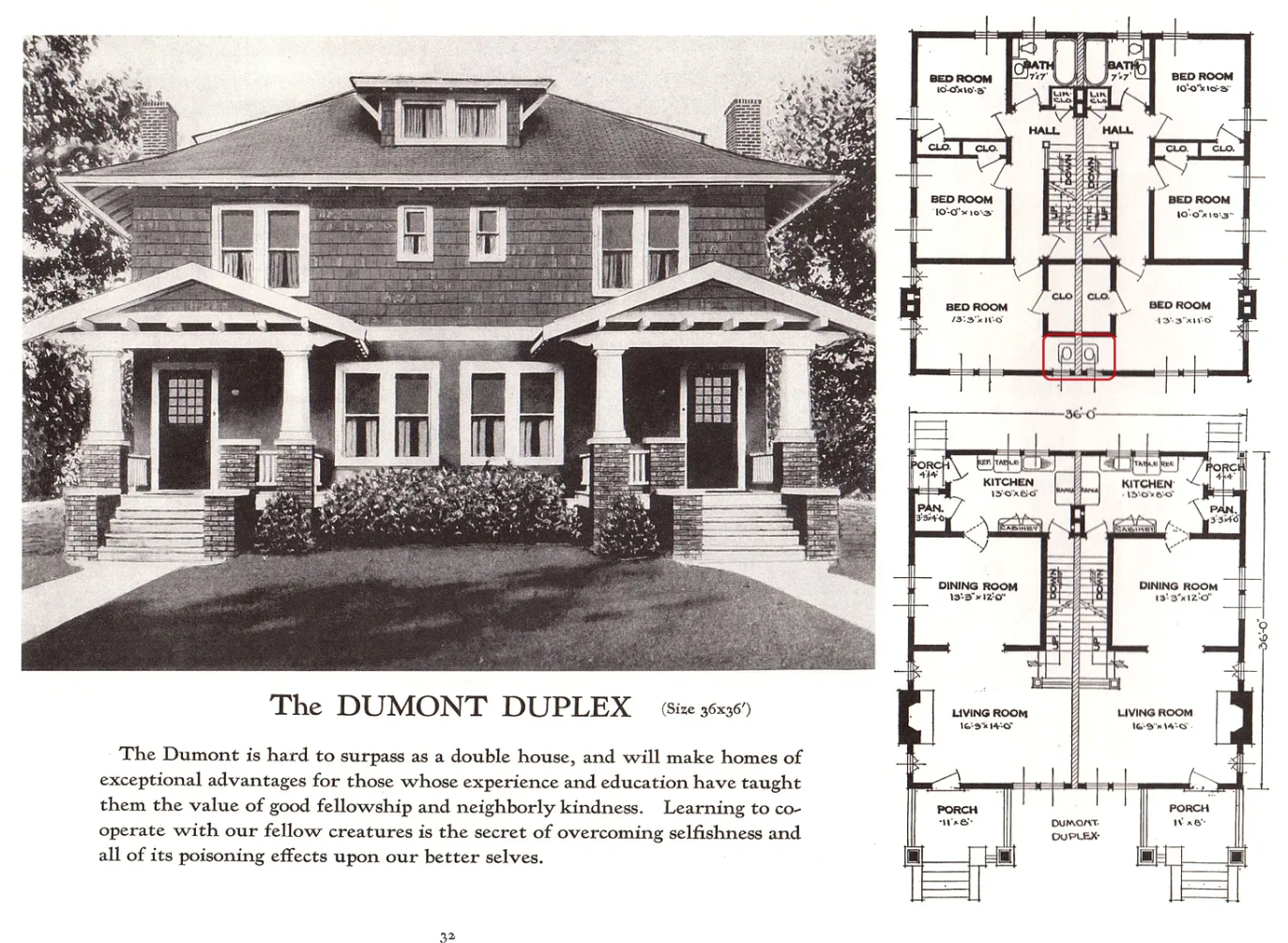

Smart Move: Buying Your First Home as a Duplex

Congratulations on taking the exciting leap into homeownership! If you're considering purchasing your first home in the Twin Cities area of Minnesota, there's a unique option that might just be perfect for you: buying a duplex. Whether you're a seasoned investor or a first-time buyer, investing in a duplex can be a smart move that offers both financial benefits and lifestyle advantages. Let's delve into why buying a duplex could be the perfect choice for your first home, and how to navigate the exciting journey of becoming a homeowner and landlord all at once.

Why Choose a Duplex?

Affordability:

One of the most compelling reasons to consider buying a duplex as your first home is affordability. Unlike purchasing a single-family home, buying a duplex allows you to leverage rental income to help cover your mortgage payments. This means you can potentially qualify for a lower down payment compared to buying an investment property, making homeownership more accessible, especially for first-time buyers.

Income Potential:

Owning a duplex means you have the opportunity to generate rental income right from the start. By renting out one unit while living in the other, you can offset your mortgage expenses and build equity faster. This additional income stream can provide financial security and flexibility, whether you're saving for the future or looking to invest in other opportunities.

Flexibility and Control:

Living in one unit of a duplex gives you the unique advantage of being a hands-on landlord. You're right there on-site to address any maintenance issues or concerns that may arise. Plus, you have the flexibility to choose your own tenants, set rental terms, and manage the property according to your preferences. This level of control can be empowering for first-time homeowners who want to take an active role in managing their investment.

Navigating Your First Year as a Duplex Owner:

Understanding Insurance:

When purchasing a duplex, it's essential to have the right insurance coverage in place. Unlike traditional homeowners insurance, you'll need a specialized policy that provides coverage for both your living space and the rental unit. Make sure to consult with an insurance agent who specializes in rental properties to ensure you have adequate protection against potential risks.

Finding Your First Renter:

Finding the right tenant for your rental unit is crucial for a successful landlord-tenant relationship. Take the time to screen potential renters thoroughly, including conducting background checks, verifying employment and income, and checking references. Building a positive relationship with your first renter sets the tone for future tenants and can contribute to a smooth and hassle-free rental experience.

Exploring Rental Strategies:

As a duplex owner, you have several rental strategies to choose from. You can rent out both units to long-term tenants, rent out one unit while using the other for short-term rentals like Airbnb, or even consider house hacking by renting out individual rooms within your unit. Explore the options available to you and choose the strategy that aligns with your financial goals and lifestyle preferences.

Leveraging Lower Down Payments:

Buying a duplex as your first home offers the advantage of lower down payment requirements compared to purchasing an investment property. By taking advantage of programs like FHA loans or conventional loans with low down payment options, you can secure financing with as little as 3-5% down. This lower barrier to entry makes duplex ownership more accessible for first-time buyers and allows you to start building wealth through real estate sooner.

Applying for Property Rental Permit in Minneapolis:

If you're considering renting out one or both units of your duplex in Minneapolis, it's essential to familiarize yourself with the local regulations and requirements for obtaining a property rental permit. In Minneapolis, landlords are required to obtain a rental license for each rental property they own. Here's a brief overview of the steps involved in applying for a property rental permit:

Check Eligibility: Before applying for a rental permit, make sure your property meets all eligibility requirements set forth by the City of Minneapolis. This includes compliance with housing maintenance codes, zoning regulations, and safety standards.

Complete Application: Once you've confirmed eligibility, you can proceed with filling out the rental permit application. Be prepared to provide detailed information about yourself, the property, and your rental plans.

Schedule Inspections: As part of the application process, your property will need to undergo inspections to ensure compliance with housing, fire, and safety codes. This may include inspections for electrical, plumbing, heating, and structural systems, as well as inspections for lead-based paint and other hazards.

Pay Fees: There are various fees associated with obtaining a rental permit in Minneapolis, including application fees, inspection fees, and annual renewal fees. Make sure to budget for these expenses when planning your rental property investment.

Receive Approval: Once your application has been reviewed, and all inspections have been completed satisfactorily, you'll receive approval for your rental permit. Make sure to keep a copy of your permit on file and display any required signage or documentation as specified by the city.

Important Things to Look for When Searching for Your Duplex:

Location, Location, Location:

When searching for a duplex to purchase, one of the most critical factors to consider is the location. Remember the golden rule of real estate: "location, location, location." While it might be tempting to buy a property for a lower price in a less desirable neighborhood, it's essential to consider the long-term impact on your investment. Purchasing in a nicer area not only makes your property more desirable to potential tenants but also can lead to faster appreciation in property value over time. Take the time to research neighborhoods carefully, considering factors such as safety, school districts, amenities, and proximity to public transportation and employment centers. Investing in the right location can significantly impact your equity and overall success as a duplex owner.

Cost Analysis:

It's crucial to conduct a thorough cost analysis when considering purchasing a duplex, especially as your first property. While it may not always be feasible to achieve complete cash flow positivity right after purchasing, owning a duplex offers unique financial advantages. As an owner-occupant, you'll have a place to live that is yours, while also having the ability to rent out the other unit to offset expenses. This rental income can contribute towards your mortgage payments, property taxes, insurance, and maintenance costs, making homeownership more affordable in the long run. Additionally, having a duplex as your first property provides flexibility for the future – whether it's accommodating family members, providing housing for children, or leveraging the property for additional rental income down the line. By carefully evaluating your finances and considering the potential rental income, you can make an informed decision that aligns with your long-term goals and financial well-being.

By doubling down on a two-for-one (or more) unit deal, you can effectively 'house hack' your way into obtaining a rental property without having to put down 25%. This offsets your mortgage compared to what it would be if you were buying a single-family home, leaving you with a pile of equity to leverage for future goals, retirement, etc., all while getting a 'deal' on what a mortgage would be in a single-family situation

By following these steps and staying informed about local regulations, you can navigate the process of obtaining a property rental permit in Minneapolis smoothly and ensure compliance with all requirements. Remember, obtaining a rental permit is an important step towards responsible and legal property management, and it helps protect both landlords and tenants alike.

In conclusion, buying a duplex as your first home offers a wealth of opportunities for financial growth and personal fulfillment. By understanding the unique aspects of duplex ownership and taking proactive steps to navigate the rental process, you can set yourself up for success as a homeowner and landlord in the vibrant city of Minneapolis. So don't hesitate to explore your options and embark on this exciting journey towards building wealth and creating a brighter future for yourself and your community.

For any questions or someone to bounce ideas off of on the Duplex/Multi Family home buying process - drop a line or ring me at: 612.305.8199 or alison@heathcotehomes.com.